1. What Is Delivered Duty Paid (DDP)?

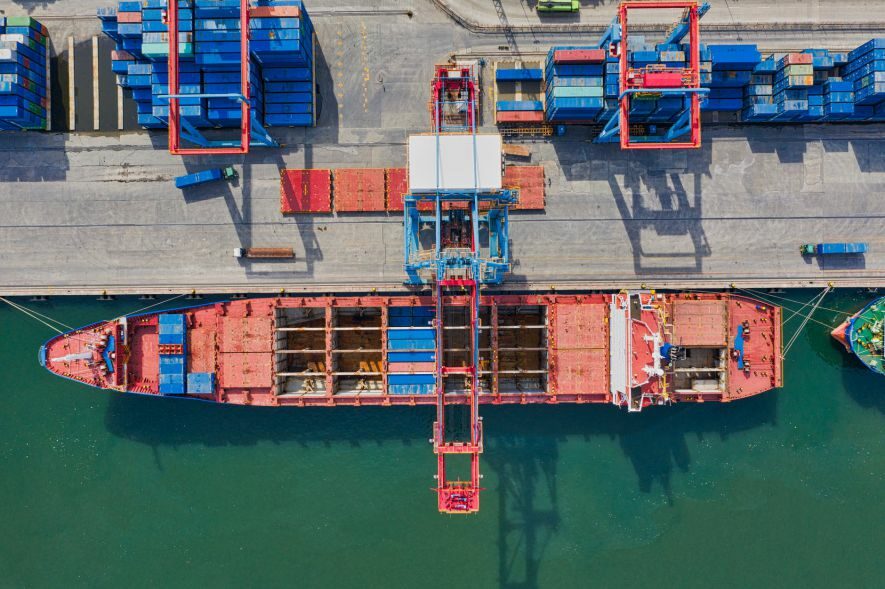

DDP, one of the Incoterms rules established by the International Chamber of Commerce, is an Incoterms rule that is widely used in international trade. DDP stands for “Duty Paid Delivery”, which means that the seller delivers the goods when they are placed at the buyer’s disposal, clears the imported goods on the arriving conveyance, and is ready to unload them at the named place of delivery.

Under this Incoterms, the seller shall bear the maximum responsibility. Since the seller is responsible for delivery, DDP may be at risk and may lack knowledge and requirements of the local destination.

Many companies use DDP only for air or ocean freight, and the buyer benefits greatly from DDP because the risk, liability, and cost to them is very low. While DDP is a good deal for the buyer, it can be a heavy burden for the seller because DDP can quickly reduce the seller’s profit if not handled properly.

The seller assumes all risks and costs of transporting the goods to the place of destination, has customs clearance, not only for export, but also for import, pays any liability for export and import, and carries out all obligatory customs formalities. The rules may be used independently of the chosen mode of transport, or in the case of more than one mode of transport.

Buyers usually use DDP Incoterms to interpret the Incoterms and they do not want to enter into any type of shipping contract with any entity, preferring to let the seller handle all of these responsibilities directly.

In DDP carriage, the seller bears the greatest responsibility because it involves the delivery of the goods to the buyer at the agreed destination.

2. What does DDP Incoterms include?

According to the DDP Incoterms, the SELLER is obliged to

Loading and unloading of goods

The DDP does include loading and unloading procedures, which are usually performed by the seller – which means that the responsibility for the entire action lies with the seller.

- Stage1:The goods are loaded and transported to the port.

- Stage2:unloading and preparation for transportation

- Stage3:Shipment of goods

Costs

Under the terms of the DDP, the costs of the DDP are borne by the seller, including packing and loading costs, transportation and delivery costs, freight forwarding fees, dock and port loading costs, insurance and customs fees, and the costs of arranging and paying for customs clearance (both export and import)at the port of destination .

Transport and delivery conditions

Under the DDP Terms, the seller is responsible for delivering the goods to the destination agreed upon by the parties to the contract. Likewise, under DDP, the seller is responsible for paying the freight charges. The transportation-related activities involved in this process may include road transportation, shipping, and transportation to a named place. Ensure that the goods reach their destination, as the seller’s risk and liability ceases only when the goods reach the agreed delivery point.

Insurance

In terms of insurance, although the DDP terminology does not require the seller to bear the cost of insuring the goods, according to the DDP allocation of authority and responsibility, the seller will bear all the responsibility and costs of the goods at the destination before customs clearance (including customs clearance), in order to prevent unnecessary losses to the seller itself with the loss of the goods, the insurance premium is generally borne by seller itself.

Documents

All export clearance procedures at the point of origin, including any and all export licenses, quotas, special documents, etc. related to the goods.Seller provides Buyer with the following documents:

- Bill of Lading

- Commercial Invoice

- Insurance Certificate

- Packing List

- Export License

Duty and customs clearances

According to the rules, the buyer is not responsible for customs issues, since the customs procedures for importation will also be handled by the seller. In some cases, however, the import customs clearance process is risky, so the process may be carried out by the buyer, who is more aware of local requirements and practices, such as GST and VAT taxes.

Notices

Seller must give notice to Buyer of any terms of shipment and delivery during the shipping process.

And the BUYER is obliged to:

Loading and unloading of goods

After delivery of the goods by the seller, the buyer is obliged to unload the goods. If the agreed place of delivery is the Buyer’s port, unloading and loading is the Buyer’s responsibility.

Costs

The buyer is not responsible for any costs in the DDP, as all documentation is provided by the seller. The only costs incurred by the buyer are those incurred after the seller arrives at the agreed delivery location and completes the delivery.

Transport and delivery conditions

In the DDP incoterm , the buyer is normally not involved in the activities related to transportation and delivery. However, if the designated place of delivery is a port in the buyer’s country, then the buyer must load the goods and bear the transportation costs from the port to the warehouse.

Insurance

Although shipping insurance is not obligatory, most sellers prefer to purchase insurance to lower risk. So,DDP includes insurance, but since the goods are delivered at buyer’s place, there is no risk to the buyer.

Documents

The seller is required to provide documentary evidence to the buyer, so the buyer is basically under no obligation to provide DDP documentation. However, under some critical conditions, the seller may require the buyer to assist in the documentation and import clearance process.

Duty and customs clearances

The buyer is not responsible for customs, as import customs will also be handled by the seller. In some cases, however, the import customs clearance process can be risky, so the process may be handled by the buyer, who has a better understanding of local requirements and practices, such as GST and VAT taxes.

Notices

If both buyer and seller agree that the place of delivery shall be determined by the buyer, the buyer is responsible for informing the seller accordingly. In addition, Buyer is obliged to give Seller sufficiently detailed notice of the time, conditions and place of delivery of the goods.

3. Does DDP shipping include VAT?

Yes, DDP will assign responsibility for payment of any import taxes, especially VAT, to the seller. However, this can be changed by agreement between the buyer and seller. The parties may agree in the sales contract that the VAT or other taxes are to be paid by the buyer.

DDP shipments are required to be shipped with any VAT paid by the sender. VAT can be expensive, sometimes 15-20% of the value of the goods, plus customs duties. In many cases, depending on their handling of the goods, the buyer may be entitled to a VAT refund. The VAT refund goes to the buyer. This means that, in the best case, you must take in the VAT; in the worst case, you take in the VAT and your customer gets the VAT refund.

4. Does DDP include customs clearance?

Yes. As with VAT, DDP Incoterms involves the sender paying for customs clearance.In the DDP agreement, it is stipulated that the seller of the goods is responsible for customs clearance, including import duties or VAT. So when the buyer purchases a product under this agreement, they are not responsible for the costs associated with customs clearance.

Any commercial goods, whether for import or export, require customs clearance by the customer.

The type of documentation required for customs clearance usually depends on the type of goods being transported. It may also vary depending on the country of origin and destination of the goods. In general, however, most businesses need to follow a common set of documents when importing or exporting goods.

12 Documents Required for Export Customs Clearance

- ProForma Invoice

- Customs Packing List

- Country of Origin or COO Certificate

- Customs Invoice

- Shipping Bill

- Bill of Lading

- Bill of Sight

- Letter of Credit

- Bill of Exchange

- Export License

- Warehouse Receipt

- Health Certificates

5. Who pays for DDP shipments?

In a DDP agreement, the seller of the goods is responsible for all shipping costs, whether they are customs clearance fees or import duties and VAT. In simpler terms, the seller pays for all costs associated with getting the goods to the buyer. However, it should be clear that the buyer is responsible for any costs associated with unloading the goods.

6. Does DDP include unloading?

No, in Incoterm DDP,the goods are placed at the buyer’s disposal at the agreed destination location or at a location within that location, rather than being unloaded from the arriving conveyance. The seller is not required to unload the goods.

Buyer assumes all risk of loss of or damage to the goods once Seller has delivered them as specified.

If Buyer fails to inform Seller exactly where the goods are to be delivered, or fails to assist Seller with import formalities, Buyer assumes the risk of loss or damage to the goods as of the agreed date or agreed delivery period.

7. DDP Advantages for the Buyer

- The buyer is not responsible for any delivery costs, taxes or contingencies incurred during transportation and delivery. This can often be beneficial, as there may be unknown costs in transit, as both the exporting and importing countries may require varying degrees of inspection, where these costs are always passed on to the shipper.

- Inspection fees can be high, and although they are not charged in most cases, this is an aspect that should be taken into account. When purchasing under DDP terms, this risk disappears because, even if this happens, the fees are paid by the seller.

- They do not need to pay additional fees. In other words, the duty paid means that the buyer pays the delivery costs and duties into the price of the product. Once the product arrives safely, they are not liable for any additional charges.

- Once the product starts shipping, the buyer just has to wait for the goods to arrive and accept them on time. This takes a lot of pressure off the buyer, because they know that the seller will be responsible for anything that may happen to the product during shipping.

- Another way to make the DDP more favorable to the buyer is to minimize the risk of shipping delays and substandard logistics companies when drawing up the purchase agreement.

- And if the seller can agree to use a specific logistics company that specializes in shipping and delivery from two destinations, and they set an accurate delivery date, the overall advantages outweigh the disadvantages.

8. DDP Disadvantages for the Buyer

- Since sellers are responsible for customs clearance procedures, they need experts in customs clearance, VAT, or import taxes in the destination country, and as such, the chances of error are high. Even if the supplier feels confident that their local freight forwarder is able to assist, the buyer has no way of confirming that the local agent is qualified to handle the corresponding delivery.

- So obviously, when a shipper lacks the qualifications, a mistake can quickly lead to disaster and the cost of fixing the mistake will continue to increase. One thing buyers need to consider is how much effort the seller is willing to put into correcting the problem before they give up on the fix and abandon the shipment.While this may be a huge loss for the seller, it will also be a huge loss for the buyer because the deposit has already been paid for the product and a lot of time has been spent in the production and shipping process.

- When sellers are responsible for shipping, they must find the cheapest option for their own financial benefit. If the seller chooses the cheapest but least reliable option (because it’s cheaper), the chances of something going wrong, whether it’s loss or damage to the goods, increase exponentially.While this ends up costing the seller more, it is a risk they need and are willing to take because the more they can save, the more they can profit.

- When sellers are responsible for shipping, they will almost always choose the slowest option because it’s the cheapest for them. So the delivery time will be longer. At the same time, DDP Incoterms eliminates the opportunity for the buyer to control the delivery time, or to determine an accelerated delivery process if needed.

- So a delay is inevitable. Experienced buyers know that they can often reduce delays by choosing faster shipping options. While most buyers prefer to plan for the slower, less expensive option, they will often use the faster, more costly shipping option as a backup plan. When shipping via DDP, however, the buyer has no control over how the shipment is shipped.

- In the event of a problem in transit, such as a delay, buyers often have to communicate with the seller if they want to help correct any problems. However, since sellers are usually in different time zones from buyers, this slows down communication and can result in longer delays than if the buyer were able to communicate directly with a local shipping agent.

- The cost of the DDP is usually higher than the delivery charges borne by the buyer. The reason for this is that the buyer has no control over the price of the purchase, and the seller needs to factor all possible additional costs into the sale price, regardless of whether or not these costs are actually incurred.

So when purchasing through DDP terms, the buyer will undoubtedly pay the highest price per delivery.

9. Shipping with Post Pony

Post Pony is a one-stop platform provides discounted shipping and oversea warehousing services in United States. Headquartered in Los Angeles, with warehouses in Los Angeles, New York, New Jersey and Portland, and branches in Beijing and Shenzhen.

By integrating multiple channels and developing an order management system, an extensive logistics network has been established. Ensure low operating costs and excellent customer experience.

We support freight consolidation and door-to-door pickup services by opening our Los Angeles and New York warehouses. Benefit from our technical team , API docking and logistics functions in the EPP integration.

If you are an online retailer, it is also suitable to use Post Pony to mail your goods, because post pony provide an all-in-one, one-stop solution for e-commerce, including order fulfillment, inventory management through integration with popular platforms and EPR software.

- E-commerce Platform

Integrating multiple platforms, with order synchronization, inventory management, online label printing and more, Post Pony enables integrated fulfillment services and efficient, highly discounted, door-to-door local delivery.

- Bulk Printing

One click to upload, quote, and manage labels for various logistics channels, more suitable for uniform specifications but with multiple addresses.

- API Integration

Helping enterprises connect with all available logistics channels, through API docking and ERP integration, ensures stability, simplicity and efficiency.

Here is a summary of the advantages of Post Pony

- üOne-stop bids platform

- üMulti-platform management, efficiency and intelligence

- üMulti-scene printing, API, ERP all available

- üProfessional warehousing team, broad range served

- üBilingual customer service, instantly response

- üTop developing team, steady system guaranteed